Political regime changes caused volatility

June was a busy month on the political front as elections in Mexico, India, France, the U.S., and the U.K. have had some surprising outcomes and varying market reactions:

- In France, President Emmanuel Macron's decision to call a snap election has unsettled markets, and the French equity index had its worst week in two years following the decision. The uncertainty surrounding the elections has raised fears of prolonged fiscal deficits and prompted credit rating downgrades, contributing to market volatility and weakening the Euro. The election's impact extends beyond France, potentially complicating the implementation of new EU fiscal rules and affecting the broader European economic landscape.

- In Mexico, the markets reacted negatively to the surprise election results and the extent of Morena party's victory, raising concerns about potential constitutional changes that could weaken institutions and create a less favourable business environment. The peso has suffered its largest fall against the USD since the outbreak of the pandemic, after having been one of the best-performing major currencies against the USD over the past couple of years.

- In India, the surprise election result with Prime Minister Modi’s party losing its parliamentary majority initially caused significant volatility in the Indian stock market, as it created uncertainty about the continuation of Modi's pro-business agenda and concerns about the party’s ability to form a stable government and continue economic reforms. However, the market showed resilience, and Indian stocks rebounded, with both major indexes recovering within a couple of days. Analysts remain optimistic about India's long-term market prospects, citing favorable demographics and ongoing geopolitical tensions between major powers as supporting factors.

- The U.K. election, which resulted in a Labour victory after 14 years of Tory rule, had a muted impact on markets, as the outcome was largely anticipated and priced in by the markets. Labour's economic agenda is viewed as moderate and prudent, not signaling significant policy shifts.

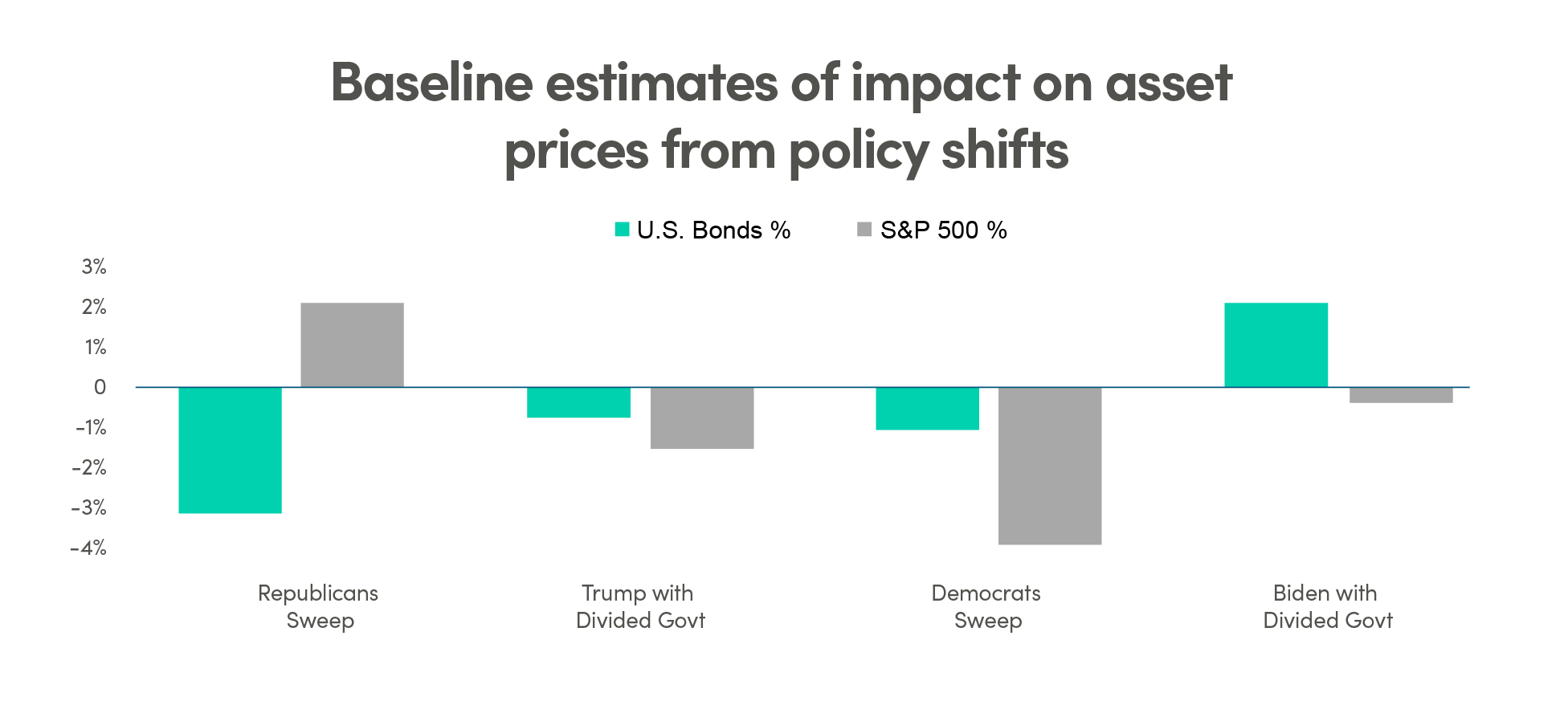

- The upcoming U.S. election has been dominating headlines with shifting poll predictions and almost daily developments, and is likely to lead to increasing market volatility leading into the November election. The divergent policy approaches of former President Trump and President Biden in areas such as international trade, taxation, immigration, and green energy initiatives could have varying implications for the economy and financial markets. Based on campaign rhetorics, a Republican sweep would likely be positive for the equity markets due to tax cuts, and negative for the bond markets due to inflationary impact of trade policies, while a Democratic sweep would be more positive for the bond markets and negative for equity markets.

Asset market shifts in four scenarios

Source: Goldman Sachs Global Investment Research.

Source: Goldman Sachs Global Investment Research.

Bottomline: While political rhetoric can create short-term noise in the markets, it continues to be corporate earnings and fundamentals that are the real drivers of long-term returns. Historical data demonstrates that markets have shown resilience and indifference under both Republican and Democratic administrations. Investors may want to take advantage short-term market volatilities as entry points but should not position their portfolios any differently based on election outcomes.

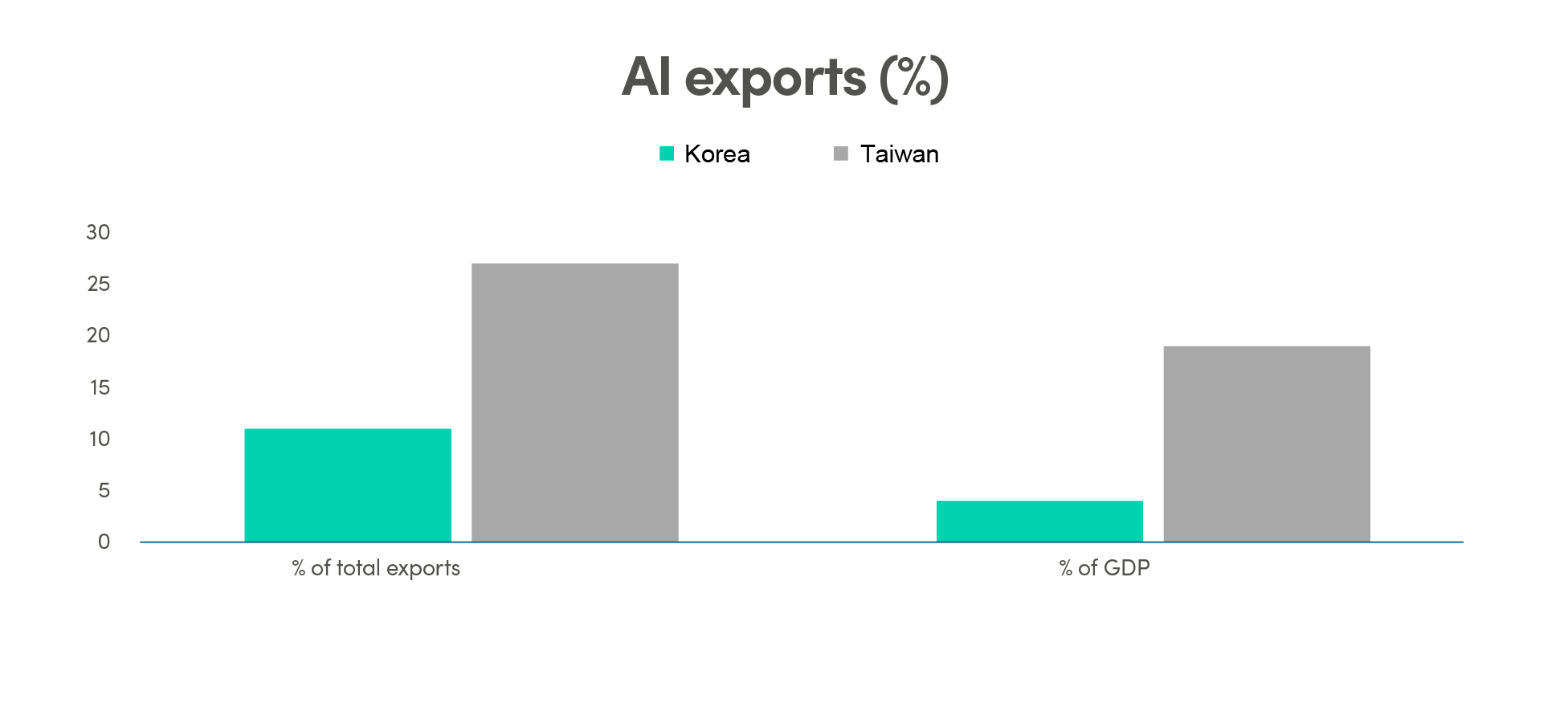

Semis push emerging markets higher

Emerging market equities have had a strong month of June and second quarter, outperforming developed markets. Chinese authorities have been rolling out policies to support the real estate market, which provided a boost to Chinese equity markets. Continued strength in demand for semiconductors is also supporting the Taiwanese equity market, buoying Taiwan Semiconductor Manufacturing Company Limited’s (TSMC) market cap to be over 51% of the MSCI Taiwan Index’s overall market cap. Exports of high-end semiconductors is also boosting Taiwan’s economic growth, where sales of AI-related products account for 27% of Taiwan’s total exports and 19% of GDP in Taiwan.

AI-related products account for a significant share of Korean and Taiwanese economies

Source: Capital Economics

Source: Capital Economics

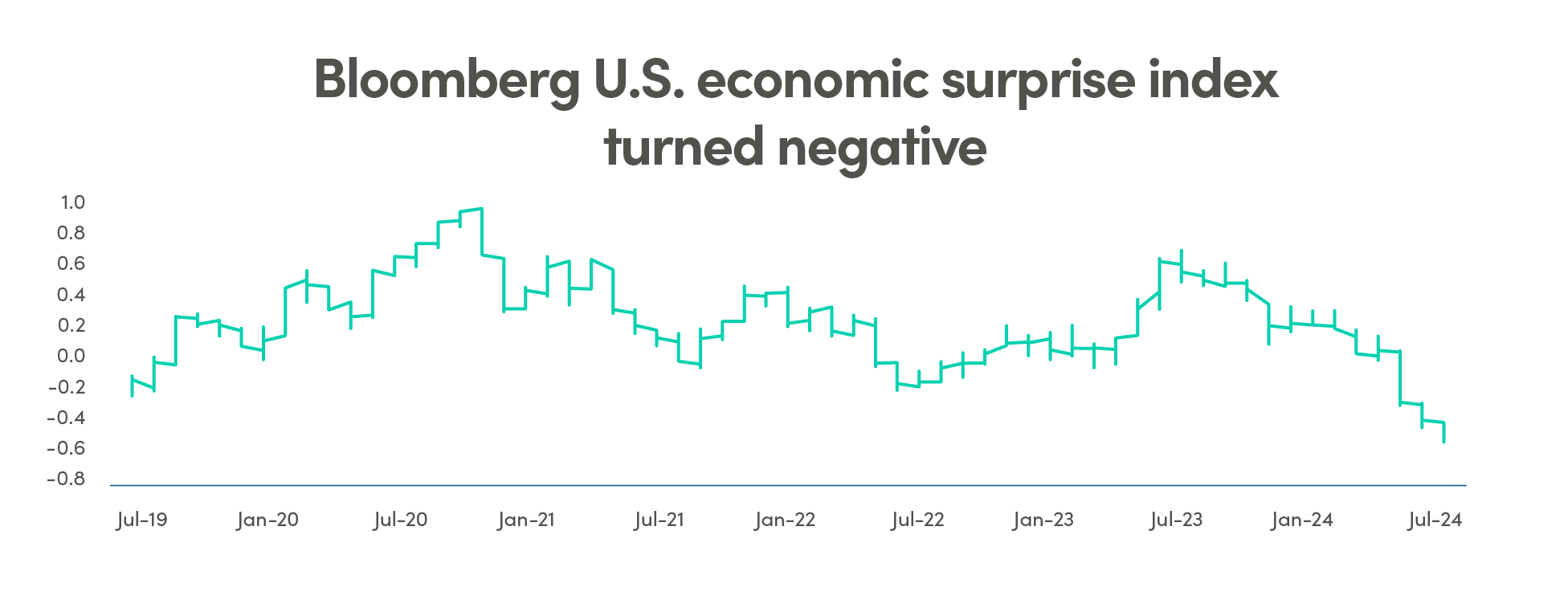

Economy – goldilocks for now but some signs of slowing in the U.S.

The U.S. economy has been delivering one upside surprise after another since the pandemic but that has started to show signs of slowdown recently as retail sales and consumer confidence are starting to miss expectations.

Source: Bloomberg

Source: Bloomberg

The depletion of excess savings, particularly among lower-income groups, is starting to dampen consumer spending, a key driver of the U.S. economy.

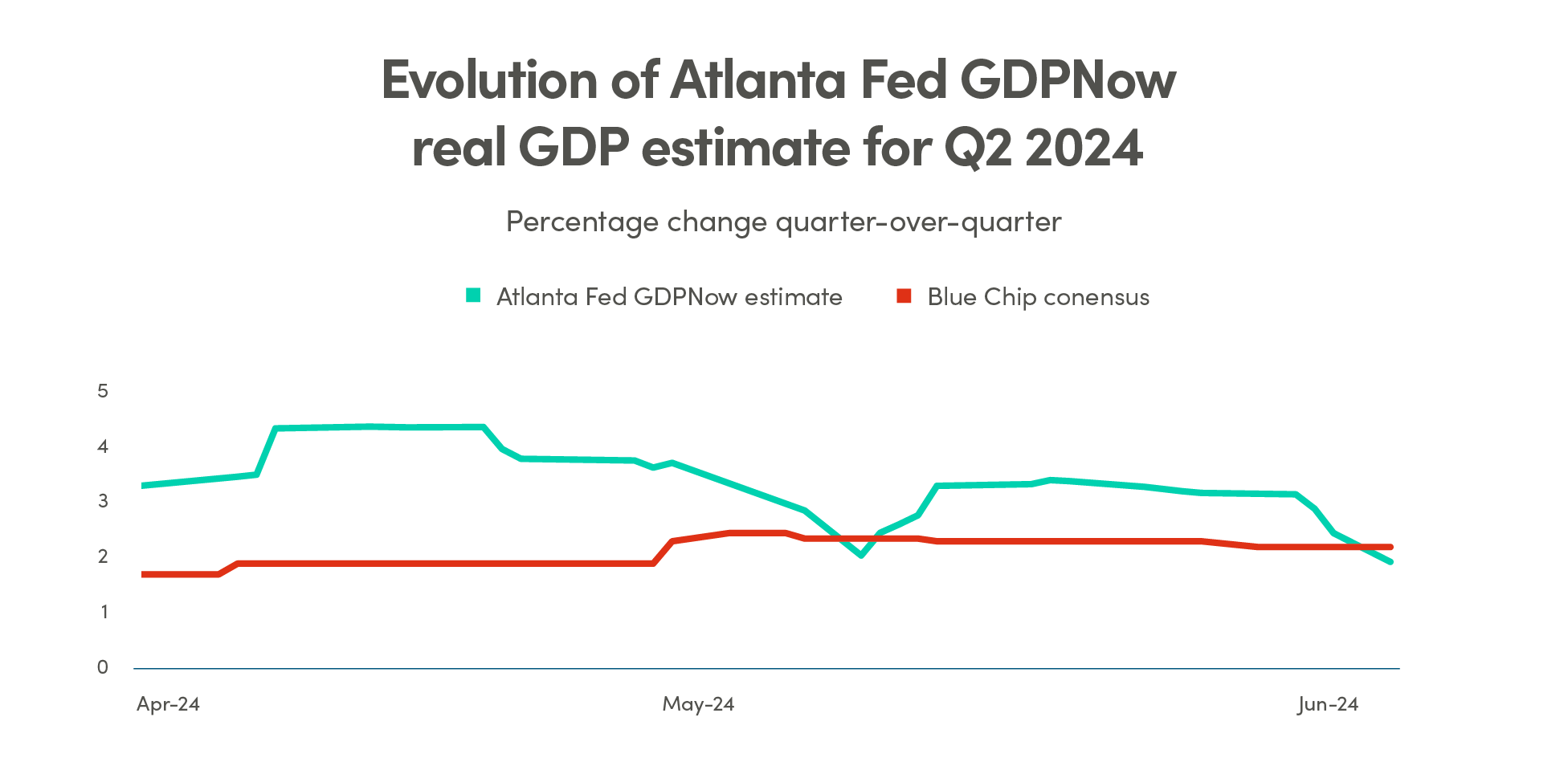

The Federal Reserve Bank of Atlanta (Atlanta Fed) GDPNow forecasting model, a higher frequency measure of economic growth, for Q2 has fallen from 4.2% to 1.8% in 4 weeks. It is now below the consensus estimate for the first time in a long time. Weak manufacturing data fueled speculation that the economy is slowing.

Source: Bloomberg. Atlanta Fed Nowcast.

Source: Bloomberg. Atlanta Fed Nowcast.

Additionally, the gradual rebalancing of the labour market may further contribute to this slowdown. Data releases on job openings and labour market turnover survey is lagged by a month, but they are important inputs to assess labour market tightness. The April Job Openings and Labor Turnover Survey (JOLTS) data pointed to a continued easing in the labour supply/demand imbalance. This should give the Fed tentative confidence that the labour market is rebalancing and in turn, inflation pressures overall will continue to subside.