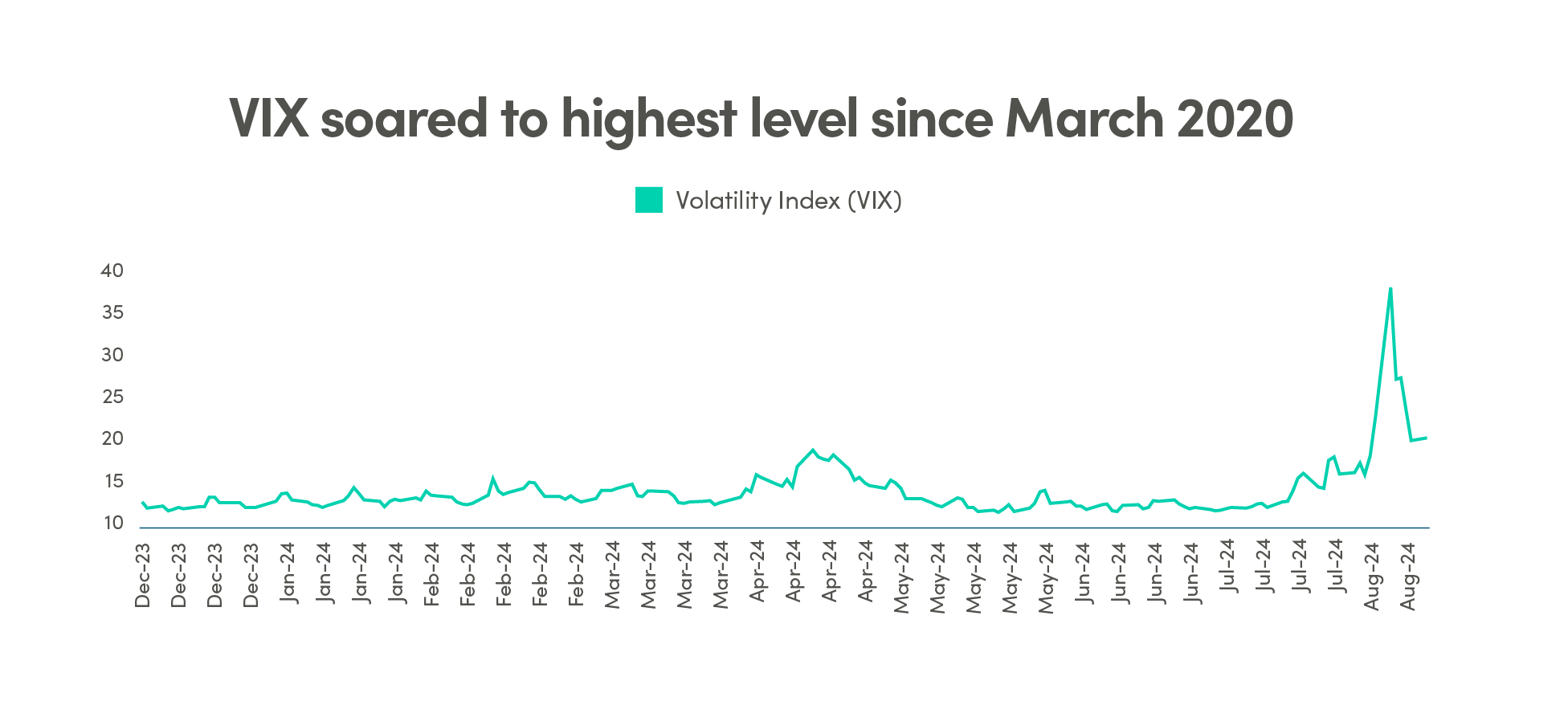

Panic selloff spiked volatility

Index volatility soared in the first three trading sessions in August, hitting an intraday high of 65. This in turn exacerbated market selloffs as it triggered the unwinding of “dispersion trades”. Dispersion trades involve selling options on an index, which is typically relatively overpriced, to buy options on individual companies, which are typically underpriced. When index volatility soars, profitability on these trades sours, and the unwinding of these trades can exacerbate the selloff and volatility of the markets.

Source: Bloomberg

Source: Bloomberg

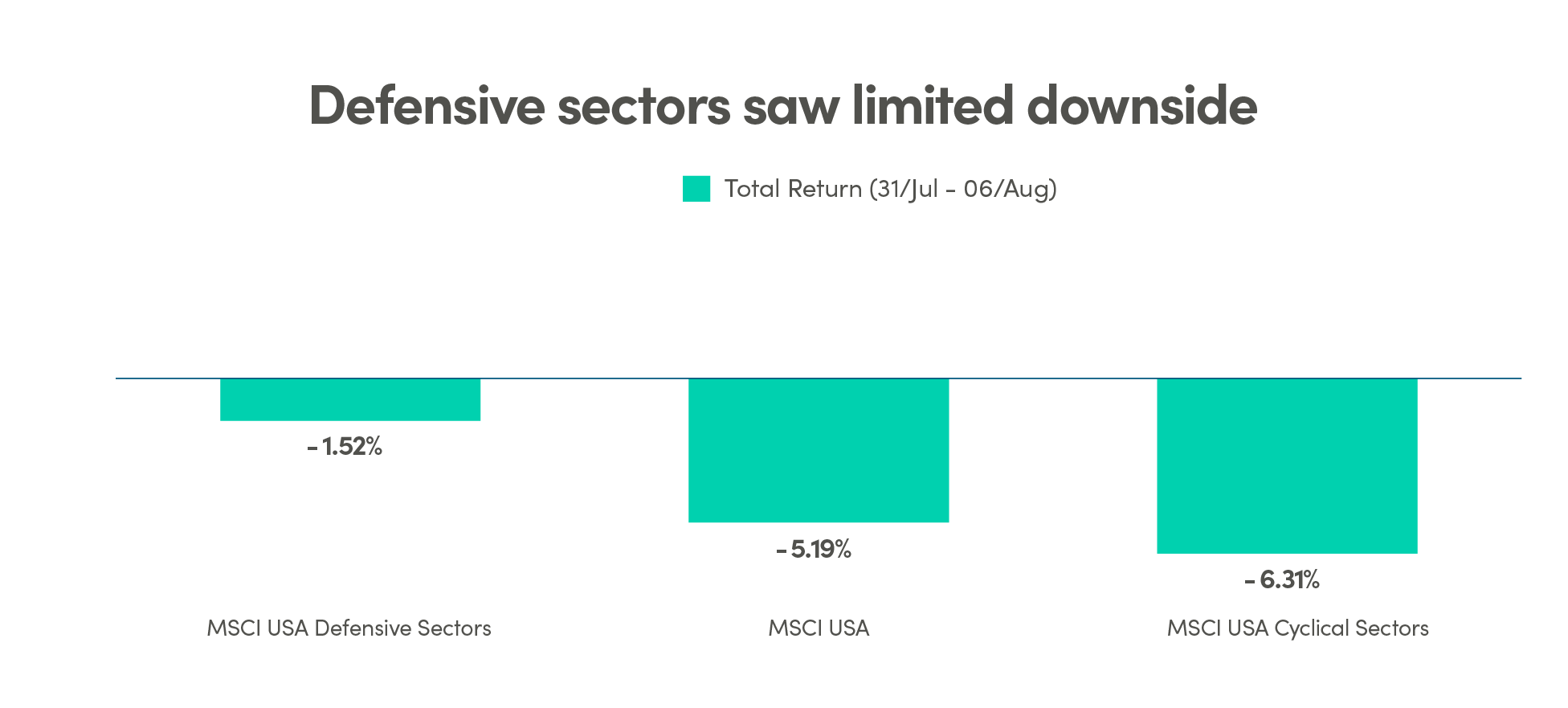

In this panic selloff, the magnitude of the drawdowns varied greatly by sectors and factors. Defensive sectors stood out as safe havens relative to the cyclical sectors. Low valuation held up better than companies that are rich on valuation, and large-cap companies outperformed small-cap companies. Importantly, bonds fulfilled their traditional risk mitigating role as higher bond prices offset stock price weakness during this period. We expect this relationship to be the norm going forward, unlike the past few years where higher interest rates caused both bonds and stocks to fall at the same time.

Source: Bloomberg

Source: Bloomberg

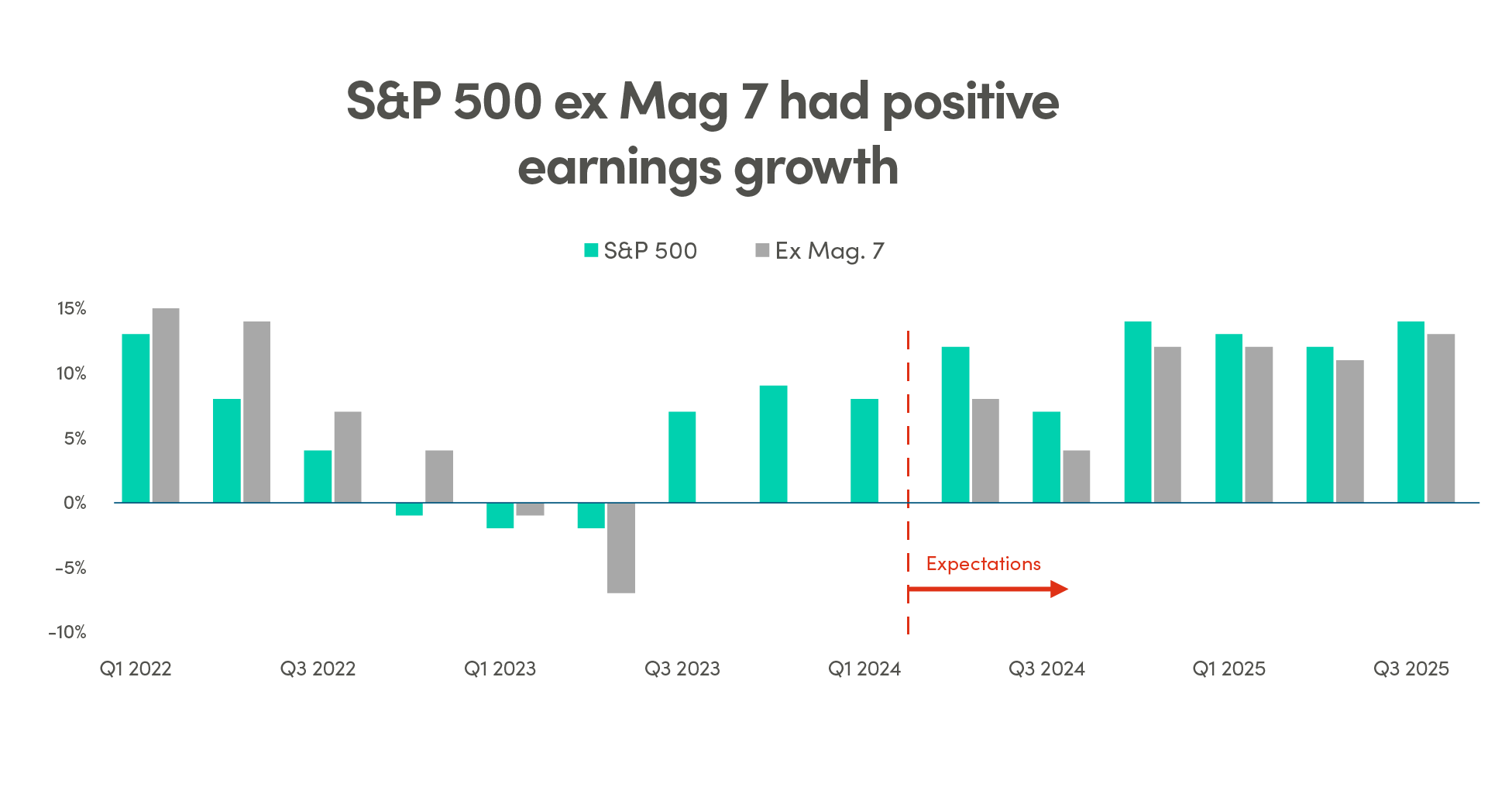

Double digit growth in U.S. earnings in Q2

91% of the companies in the S&P 500 have reported earnings so far, and 78% are reporting EPS higher than estimates. Although the percentage of S&P 500 companies reporting positive earnings surprises is above average levels, the market’s high expectations are rewarding positive EPS surprises less than average and punishing negative EPS surprises more than average. Overall, the index is reporting its highest year-over-year earnings growth rate at 10.8% since Q4 2021, the fourth consecutive quarter of year-over-year earnings growth. It also marks the first quarter since 2022 where the other 493 companies reported positive quarterly earnings growth.

Source: Factset

Source: Factset

Looking ahead, consensus estimates for earnings growth in Q3 and Q4 of 2024 stand currently at 5.4% and 15.7%, which translates to earnings growth of 10.2% for the calendar year 2024, suggesting a resilient U.S. economy. Following the Q2 reporting season, estimates for FY2025 earnings have held steady and resilient, at almost 14% growth, making the U.S. the strongest country among developed markets.

Bottomline: The U.S. equity market continues to be concentrated not only on price returns but also earnings contribution. A small number of companies are contributing a significant portion of earnings, increasing volatility and vulnerability on the index. Notwithstanding the latest drawdown, the premium on U.S. valuations reflect a soft-landing scenario with high expected earnings growth. Companies require material upside catalysts to get further upside or valuation gain, while companies that deliver negative surprises get punished. We expect the U.S. market to be rangebound until year-end, and investors need to be selective and stay disciplined with regular rebalancing to mitigate concentration risk.

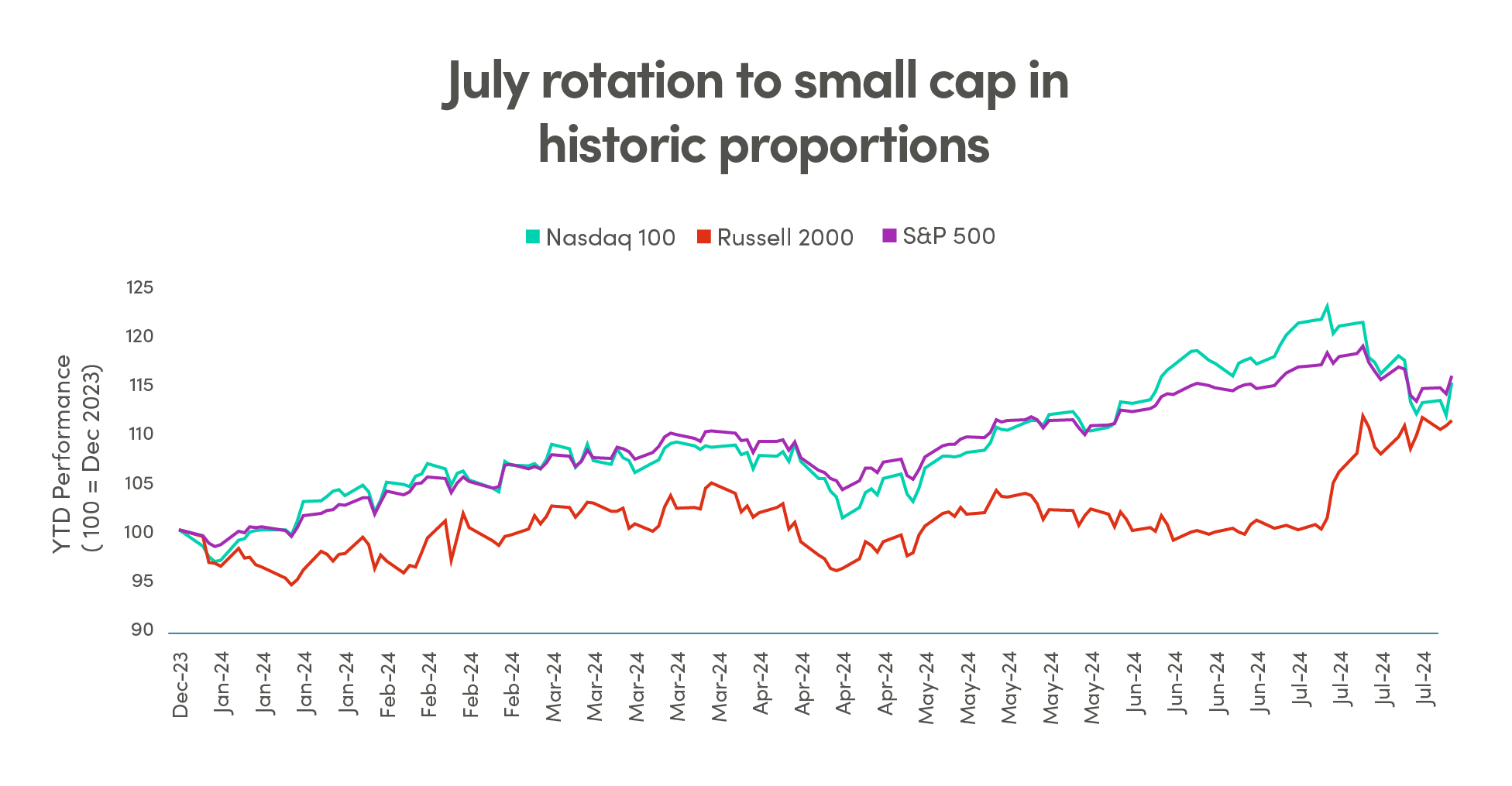

July rotation to small cap in historic proportions

One of this year’s laggards played catch up in July, as investors shifted towards small-cap equity stocks, which are more sensitive to interest rate cuts. The increased likelihood for rate cuts, following the soft U.S. inflation print and weaker U.S. labour market data, likely triggered the largest one-month outperformance in over 20 years of the Russell 2000 versus the Nasdaq 100 Index of 13.34%.

Source: Bloomberg

Source: Bloomberg

Bottomline: The rotation was surprisingly sooner and bigger in magnitude than expected, as small cap rotation typically happens when economic growth begins to accelerate, not when it’s decelerating, and forward-looking earnings growth in the small-cap companies typically needs to be accelerating as well. It is not the case at this point. While we continue to believe that the high-quality segment within the small-cap space is attractive, we believe this rebound could be short-lived, and the more sustainable recovery could still be ahead.