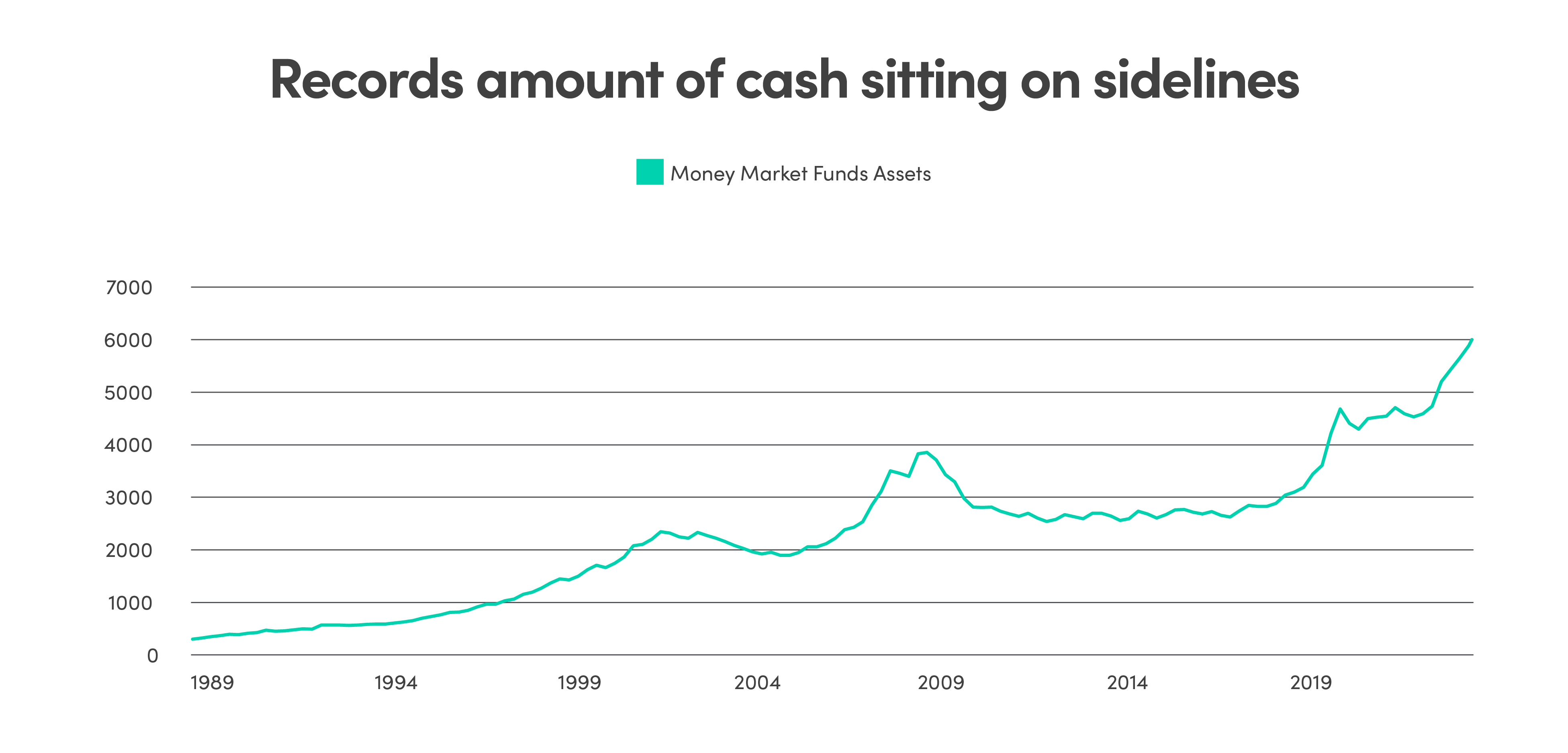

Investors still sitting in cash

With GIC maturity dates approaching for many investors and GIC rates coming down, investors are likely to start reinvesting the money that has been on the sidelines back into the market.

Source: Bloomberg, NEI Investments

As short-term rates fall, money market instruments will become increasingly less attractive compared to fixed income and equities. This is an opportune time for investors to get off the sidelines and to redeploy capital back to risky and growth assets, which may provide a strong technical boost to drive markets higher.

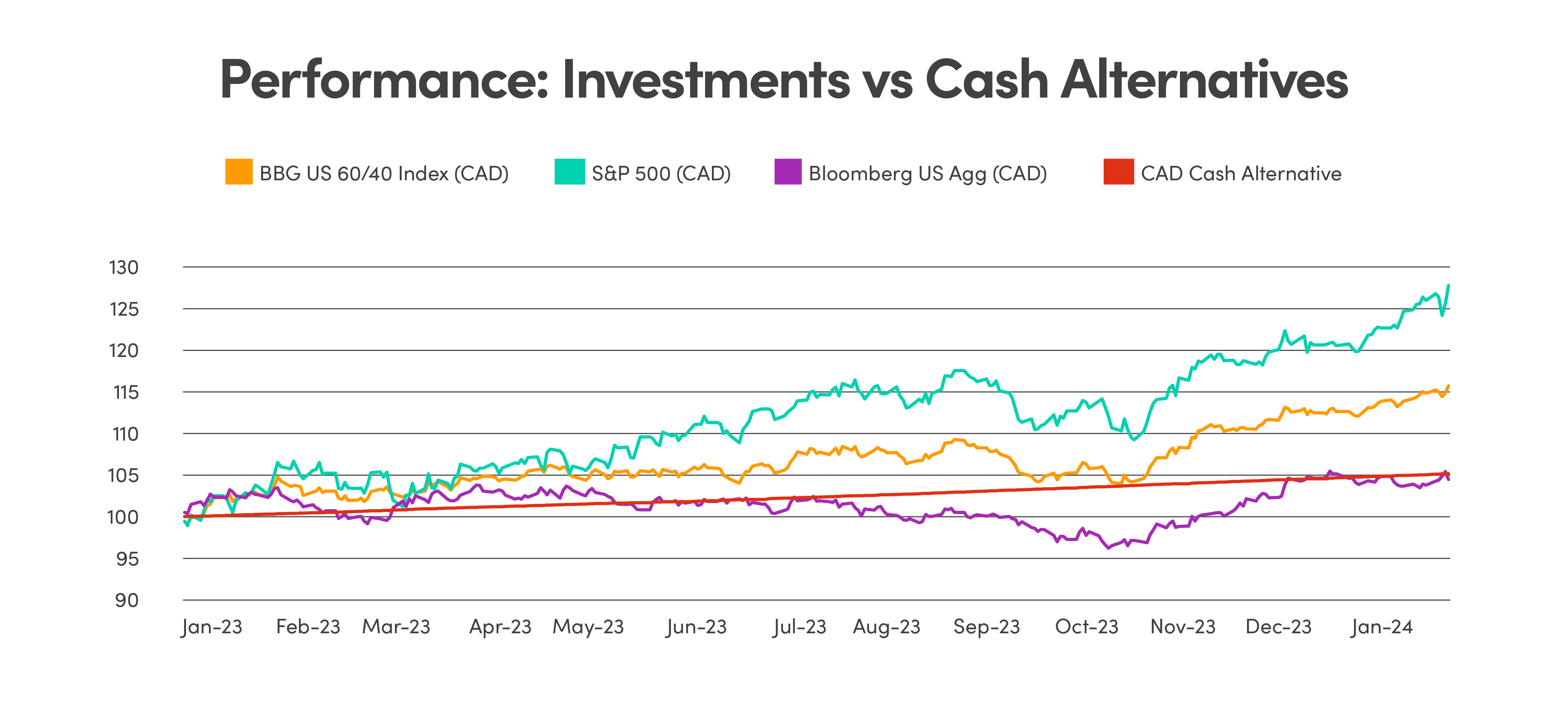

The traditional 60/40 portfolio performed well in 2023, and with higher yields and end of monetary tightening, we believe it is well positioned for 2024 as well. This demonstrates the opportunity cost investors face when sitting on the sidelines.

Source: Bloomberg, NEI Investments

Magnificent 4 drive S&P 500 to new highs

Bullish sentiment continued in January, helping the S&P 500 reach a new record with the tech sector driving most of the gains. The recent earnings reports point to a “Magnificent 4” more than a “Magnificent 7” as Nvidia, Apple, Microsoft and Alphabet were responsible for the majority of returns in the fourth quarter of 2023.

The dispersion between these stocks and the rest of the market is again increasing, defying concerns about concentration in certain shares.

But is there dispersion between these stocks’ earnings and the earnings of the remaining 493? Yes. Mega cap tech broadly beat consensus 4Q revenue estimates with an average positive surprise of 1.3%. The seven stocks generated $523 billion in sales during 4Q representing a year/year increase of 14%. Revenue growth for the remaining 493 stocks was a comparatively paltry 2%. Margins for the seven stocks expanded by nearly 750 bp year/year to 23% vs. a 110 bp contraction to 9% for the remaining 493 stocks in the S&P 500.

| Q4 2023 Results |

| |

Sales |

Net Margins |

| Ticker |

Level ($bn) |

Y/Y growth |

Level (%) |

Y/R growth |

| Nvidia |

$20 |

233% |

51% |

2775 bp |

| Meta Platforms |

$40 |

25% |

35% |

2048 bp |

| Microsoft |

$62 |

18% |

35% |

412 bp |

| Alphabet |

$86 |

14% |

24% |

594 bp |

| Amazon |

$170 |

14% |

6% |

606 bp |

| Tesla |

$25 |

3% |

23% |

1619 bp |

| Apple |

$120 |

2% |

28% |

276 bp |

| Mag 7 |

$523 |

14% |

23% |

747 bp |

| S&P 493 |

$3,398 |

2% |

9% |

(110) bp |

| S&P 500 |

$3,921 |

3% |

11% |

671 bp |

Source: Bloomberg, NEI Investments

Don’t lose sight of earnings and valuations

With 67% of companies in the S&P 500 having reported this far, S&P 500 companies have reported actual earnings that have exceeded estimates by 7.6% during this period. The earnings growth, which troughed about a year ago, seems to be on a steady recovery trend.

Forward guidance typically plays an important role in investor sentiment. However, forward guidance has tended to be too optimistic over the past few years with negative changes in earnings revisions in the first two months of the quarter. This year is starting off on a better note than historical trends; however, with 2024 earnings revisions only being revised by about half of a typical year’s revisions at this point in the year.

With S&P valuations near historical peaks, overly optimistic forward guidance may present a risk for equities. Although markets are pricing in a soft landing, and sentiment is strong, potential slowdown is still on the table, and could cause further volatility and pullback in equity markets in late cycle. In addition, bifurcation of the markets has caused lower beta, and defensive companies to be very attractively valued compared to history and relative to growth companies.