Mega caps drive markets on hope of AI revolution

The promises of a revolution based on artificial intelligence (AI) continued to be the dominant narrative and driving force of U.S. markets. Semiconductor and Graphic Processing Unit (GPU) manufacturers have so far been the main beneficiary of the AI rally, with Nvidia up over 170% and Advanced Micro Devices up over 90% year-to-date.

One of the most telling signals of the AI fever that has gripped markets and corporate America is how often “artificial intelligence” has been stated in recent quarterly earnings calls. An article in Bloomberg noted that “artificial intelligence” or “AI” has been mentioned 1,072 so far this year on company earnings calls. Most notably in large technology firms, but also across companies in other sectors from pharmaceuticals to consumer discretionary.

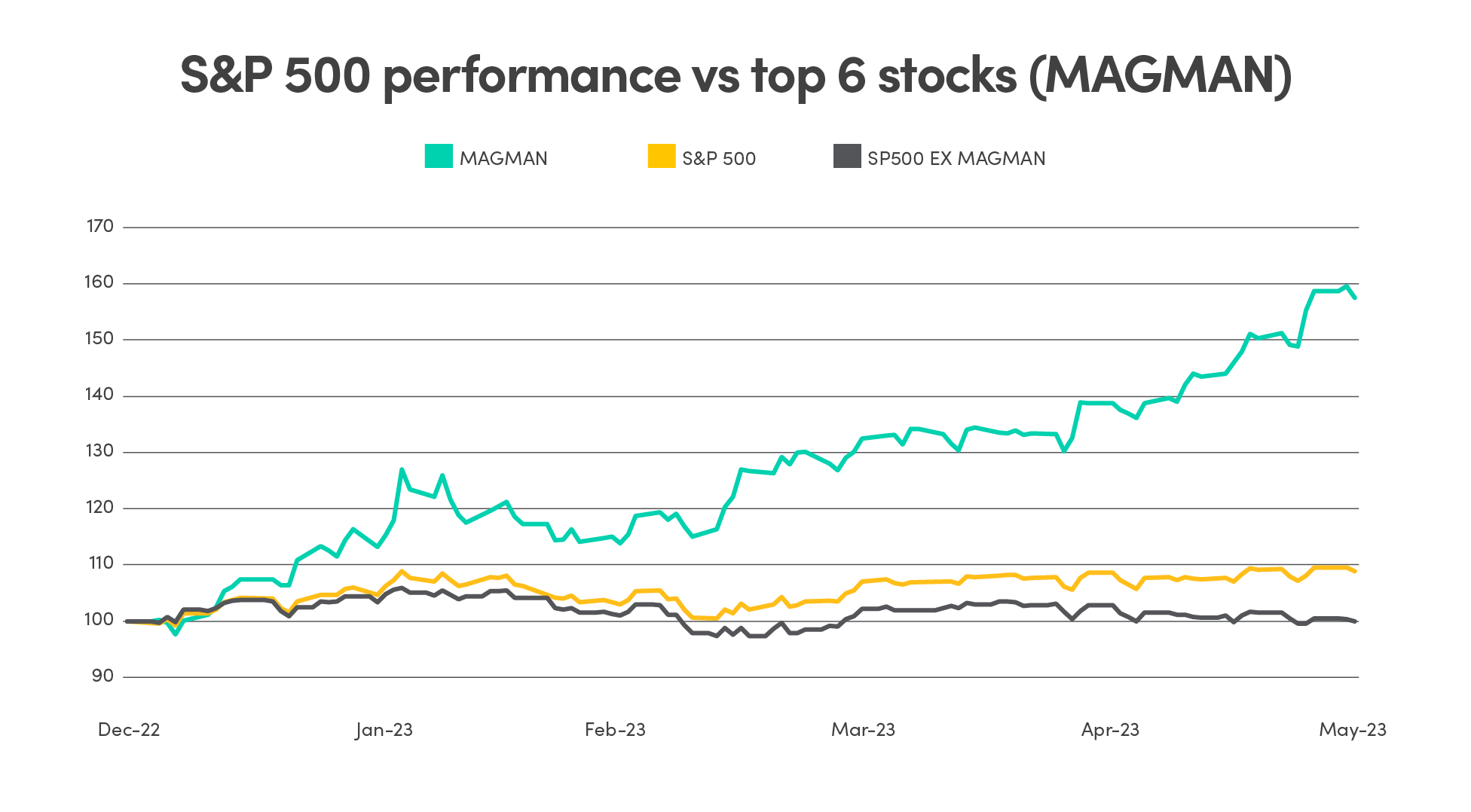

The familiar mega cap companies dubbed “MAGMAN” (Microsoft, Apple, Google, Meta, Amazon and Nvidia) continue to lead the market and are responsible for most of the year-to-date gains for the market. Nvidia’s strong rally through the month pushing its market capitalization to $1 trillion on May 30th, making it the fifth company to reach a $1 trillion valuation.

Source: Bloomberg data as of May 31, 2023

U.S. economic strength continues to surprise

The U.S. economic data continues to beat expectations and surprise to the upside despite the Federal Reserve’s attempts to cool the economy. The April jobs report released in early May beat expectations with 253,000 jobs added in April, bringing the unemployment back down to 3.4%. With an extremely tight labour market there are still 1.8 job openings for each unemployed person.

The U.S. ISM Manufacturing PMI in the United States rose to 47.1 in April, slightly above market expectations, but still indicating a sixth consecutive month of contraction in the manufacturing sector due to higher borrowing costs and tight credit. While the contraction rates softened for output and new orders, business activity continues to expand driven by the service sector.

Economic slowdown in Germany and China

Germany technically entered a recession in the first quarter of 2023 as GDP growth contracted by 0.5 percent year-on-year, revised from the preliminary estimate of a 0.1 percent decline. This was primarily due to persistently high inflation and increased borrowing costs, despite Eurozone’s inflation rate moderating faster than expected.

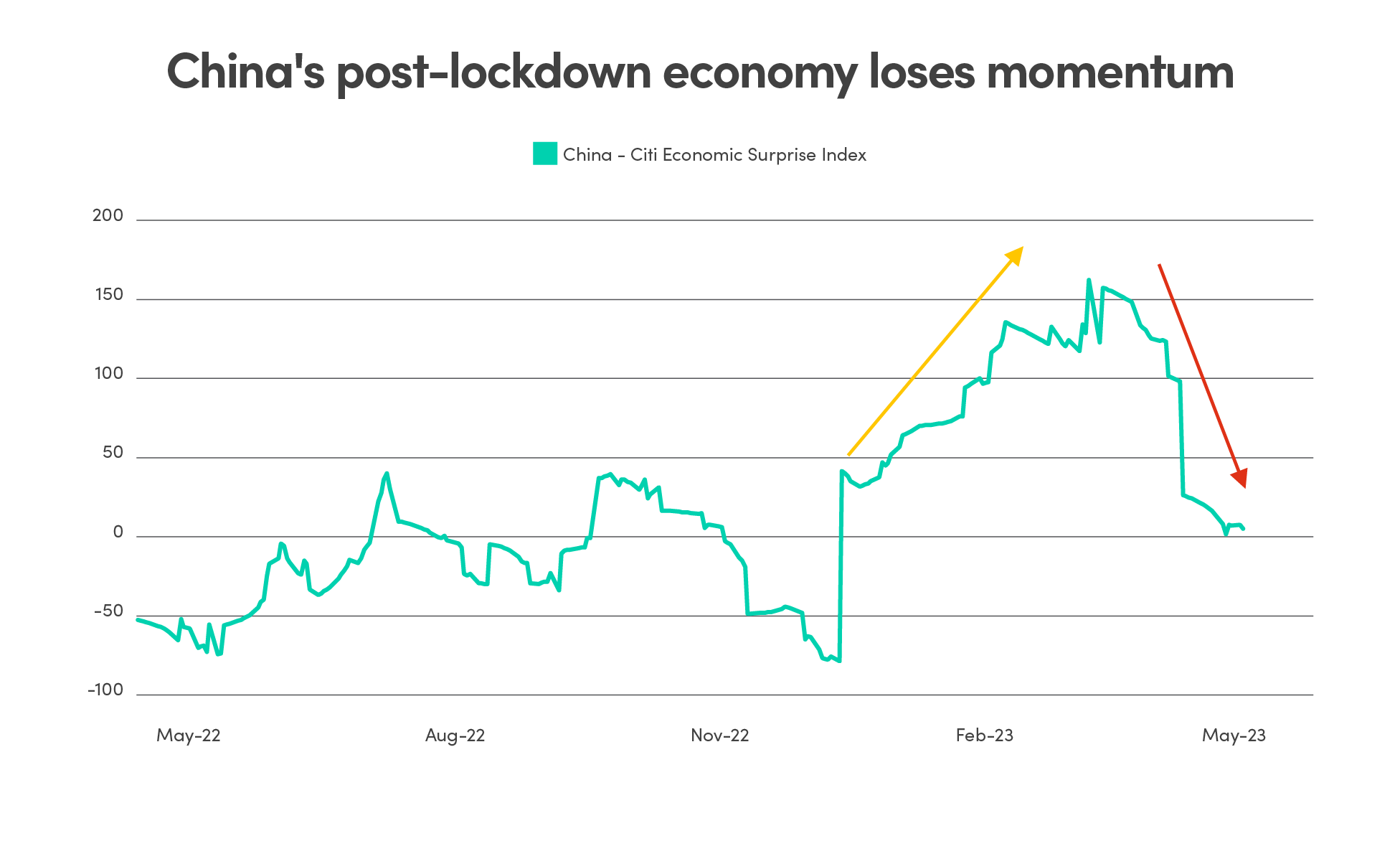

Likewise hopes for China’s post-lockdown economic boost is quickly losing momentum as recent economic data surprised to the downside. The Citi economic surprise index has reversed following consecutive positive surprises at the beginning of the year following the re-opening of the economy.

Source: Bloomberg data as of May 31, 2023

Despite economic growth of 2.2 percent, slowing inflation and soaring bank savings are starting to raise concerns about demand. China’s central bank responded by cutting lenders' reserve requirements in March to help boost demand while Beijing pledged to launch more fiscal stimulus.