Central bank policies diverge

In addition to the increasingly divergent path of regional economies, the inflation trajectories in the U.S., Canada and Euro area are also causing central bank policy responses to be less synchronized.

Canada's disinflationary momentum continued, as April's 2.7% headline CPI and moderation in core measures like CPI-Trim and CPI-Median pointed towards an imminent easing cycle by the BoC. On June 5th, the BoC led the major central banks to kick off this easing cycle and cut overnight rates by 0.25% to 4.75%.

Contrastingly, the Euro area saw an upside surprise in core inflation, with core HICP accelerating to 2.87% year-over-year in May, driven by a notable pickup in services price growth. Despite this uptick in core inflation, the European Central Bank (ECB) also kicked off the long-awaited easing cycle on June 6th, cutting rates by 0.25% to 3.75%.

The U.S. exhibited signs of easing inflationary pressures, with core CPI rising a muted 0.16% month-over-month in May, the slowest pace since August 2021. This softening has raised expectations of the U.S. Federal Reserve (Fed) to potentially to able to initiate rate cuts as soon as September.

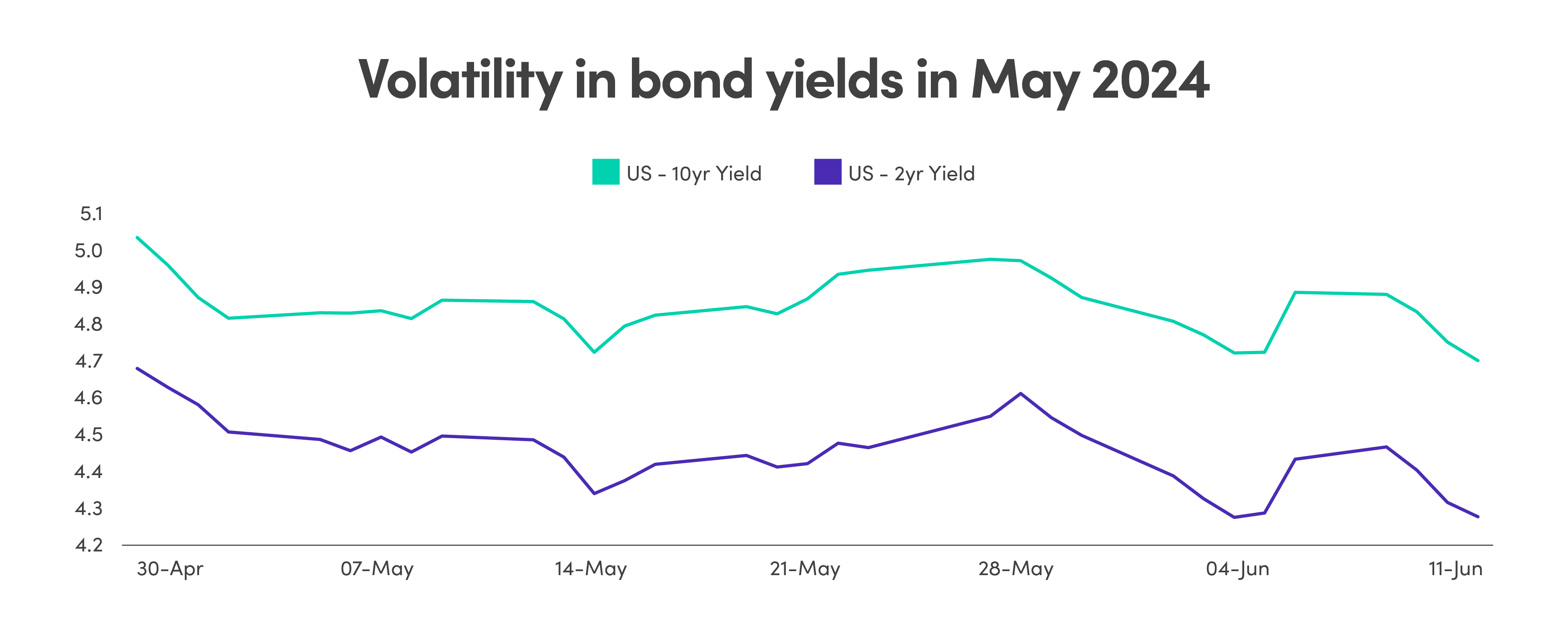

In response to fluctuating rate cut expectations, U.S. bond yields were on a rollercoaster ride in May. Both 2-year and 10-year yields in the U.S. fell by 40bps since the end of April. A weaker-than-expected April jobs report fueled speculation of an economic slowdown, causing bond yields to decrease as investors anticipated earlier interest rate cuts by the Fed. However, yields rebounded in mid-May as persistent inflation and stronger data, such as the flash PMI readings, reminded investors that the Fed might need to maintain higher rates for longer to tame inflation, with markets now pricing in one rate cut by year end, from a previously expected two.

Source: Bloomberg LP

Source: Bloomberg LP

Strong earnings of mega-cap companies lead to highest market concentration

78% of S&P 500 companies reported Q1 results that exceeded consensus estimates. The S&P 500 reported earnings growth of 6.0%, the highest year-over-year since Q1 of 2022.

However, rather than excitement based on the strong Q1 results, investors focused on forward-looking earnings guidance. 80 companies issued negative EPS guidance and they typically lagged the index despite beating expectations on actual results, while firms that raised guidance outperformed.

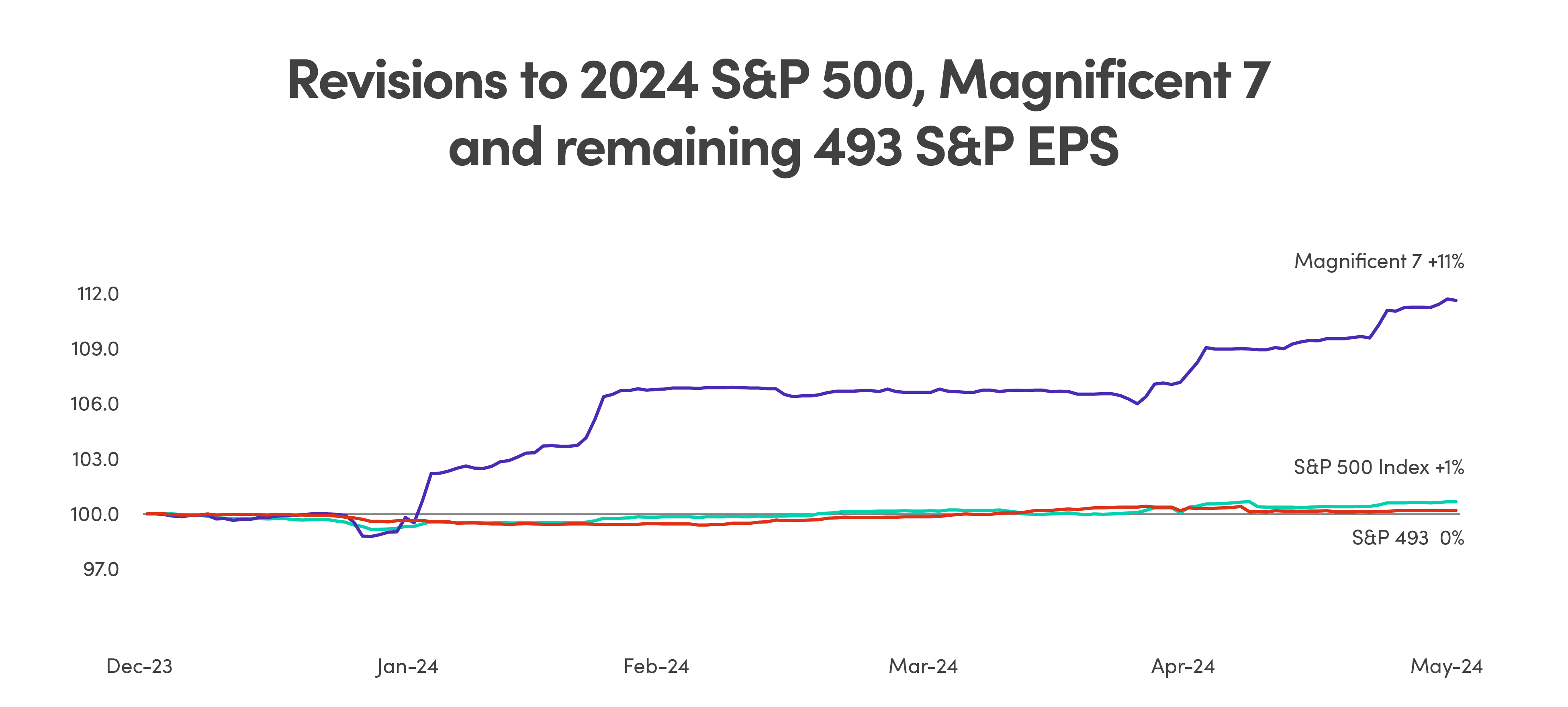

Despite the softening macroeconomic backdrop in the U.S., analysts have been revising the Q2 2024 EPS estimates upwards after the Q1 results. It has been better than usual due to rosy forward guidance from the largest firms. Analysts typically reduce earnings estimates as the year progresses, by a median of 4%. This year, however, analysts have lifted their full year 2024 EPS estimates for the Magnificent 7 companies by 11% while the estimates for the other 493 companies remained flat, leaving the aggregate 2024 S&P 500 EPS forecast revised up by 1%.

Source: FactSet, Goldman Sachs Global Investment Research

Source: FactSet, Goldman Sachs Global Investment Research

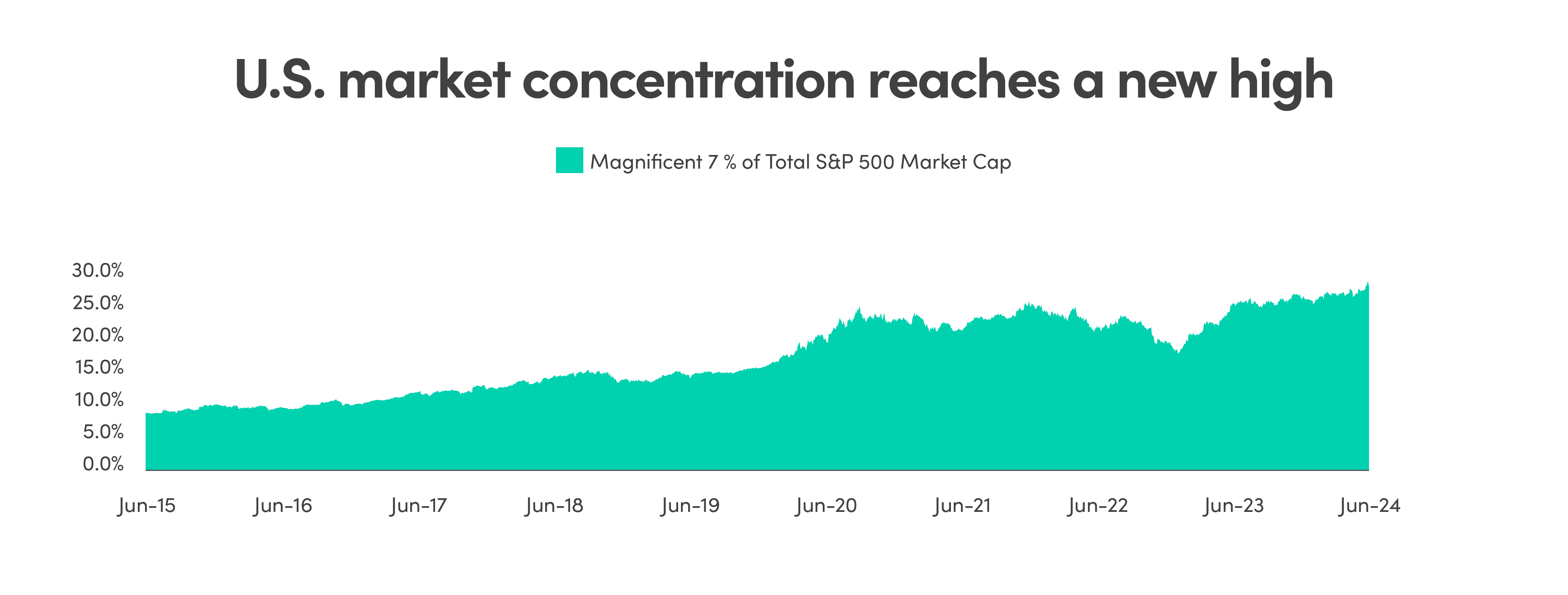

In line with their strong earnings and revisions, the mega-caps have continued to dominate market performance resulting in highest levels of market concentration in recent history, with the largest 10 stocks now representing 35% of S&P 500 index market capitalization.

The most significant contributor was Nvidia. Nvidia surged after the first quarter earnings, reporting a 260% increase in overall revenue and 500% increase in operating income driven by the company's dominance in the AI chip market catering to the surging demand from major tech giants like Google, Microsoft, Meta, Amazon, and OpenAI.

Source: FactSet, Goldman Sachs Global Investment Research

Source: FactSet, Goldman Sachs Global Investment Research

Utilities emerge as top performers

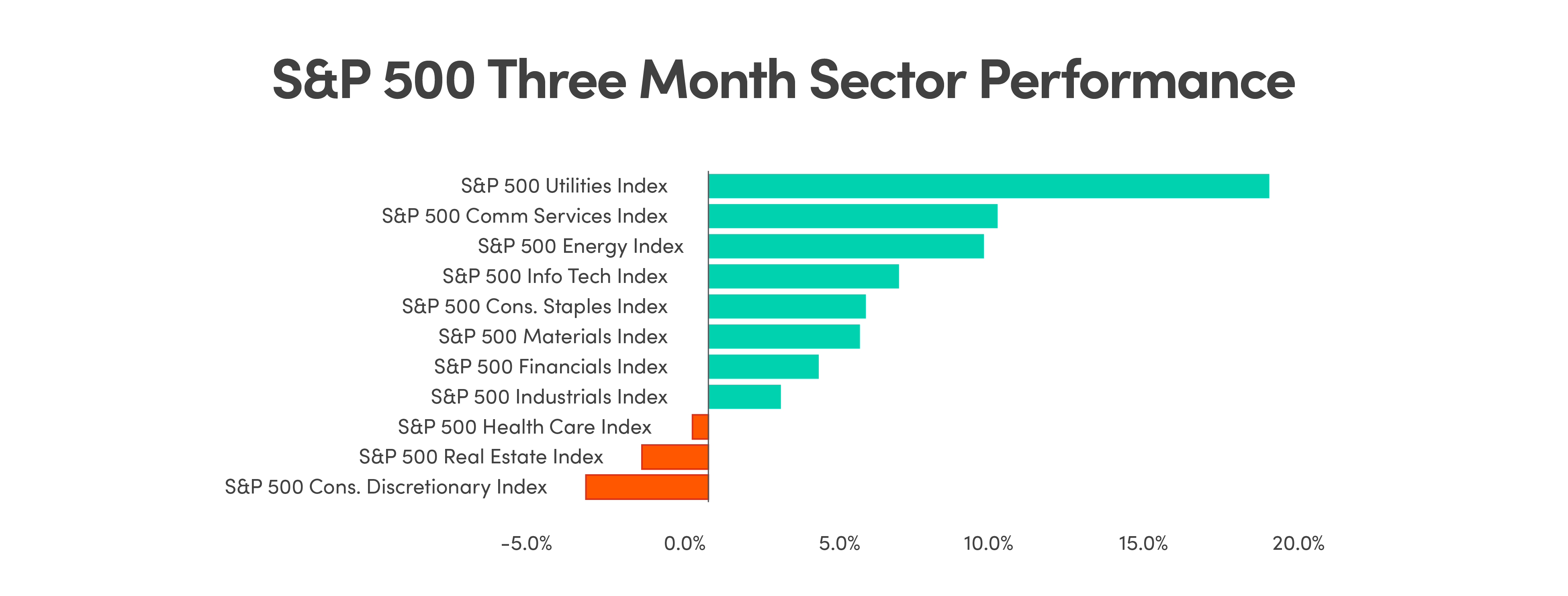

As elevated valuation and increasing market concentration poses additional risks in the U.S. markets, not to mention geopolitical risks given the upcoming election, investors have started to look outside of mega-cap technology for diversification into other more defensive sectors. Over the last few months utilities have been a beneficiary of that.

Utilities stocks have emerged as the top-performing sector over the past three months, which have experienced an expansion of multiples from very compressed levels. Tailwinds for further runway include easing monetary policies, slowing economic growth in the U.S., and the rising demand for electricity from the growth of artificial intelligence and data centers.

The rapid advancement of AI technology has led to a significant increase in the need for data centers, which consume vast amounts of electricity. As major tech companies ramp up their investments in AI and data centers, the demand for power from utilities, especially those focused on clean energy and nuclear power, is expected to surge. This has made utilities an attractive play on the AI boom.

Source: Bloomberg LP

Source: Bloomberg LP

Additionally, utilities' traditional defensive characteristics have also contributed to their outperformance, with concerns about slowing economic growth and potential rate cuts.