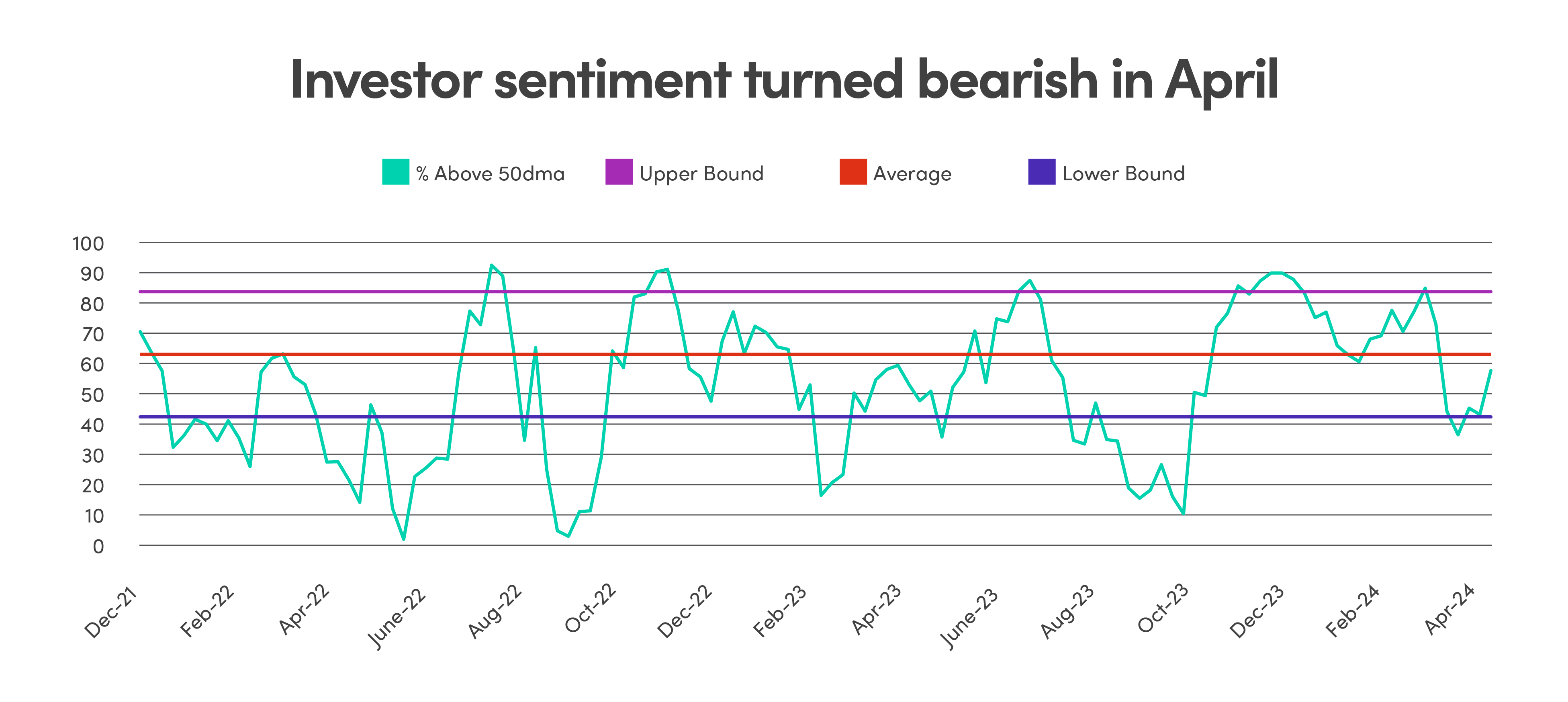

Bearish sentiment from delayed rate cuts

April saw risk aversion rise as the market narrative changed from assumptions of ‘soft landing’ or ‘no landing’ scenario to a much more concerning ‘stagflation’ environment. Uptick in the most recent inflation data, higher energy prices, and geopolitical tensions stoke concerns that inflation may re-surface, leaving little room for rate cuts despite economic slowdown. The U.S. equity markets dropped by 5% in mid-month from the close of the first quarter at a historical high.

Source: Bloomberg LP

Volatile month for Magnificent 7

Tesla has been retreating year-to-date from lower demand on EVs, but a near 40% rebound into month end caught everyone off guard. Also notable was the heightening AI frenzy in April as some semiconductor companies reported strong results. Nvidia, which has yet to report earnings, saw one of the largest single-day drops in market cap in history only to recover fully in the following four trading days. Upon a strong earnings report, Google’s parent Alphabet had the largest one-day gain in market capitalization in history. These moves helped lift the S&P 500 Index back above 5000 following a brief dip below in April.

| Name |

Earnings surprise beat/(miss)% vs consensus |

Y/Y EPS Growth |

YTD performance |

| Meta |

9.40% |

114% |

31.8% |

| Amazon |

41.80% |

227% |

22.3% |

| Alphabet |

23.60% |

62% |

18.7% |

| Microsoft |

3.90% |

20% |

10.1% |

| Apple |

1.90% |

1% |

-3.4% |

| Tesla |

-13.30% |

-38% |

-30.4% |

| Nvidia |

To be announced |

To be announced |

82.1% |

Source: Bloomberg LP

Bottomline: Uptick in inflation and geopolitical tensions caused a change in investor sentiment and led to a pullback in April, which sent the equity markets to more attractive levels. The earnings season demonstrated continued strength in corporate fundamentals, providing support for richer valuations. The sentiment may have been too pessimistic and after the pullback, current levels still present a good entry point for long term investors, as we expect the rally to resume and broaden based on strong earnings growth and economic momentum.

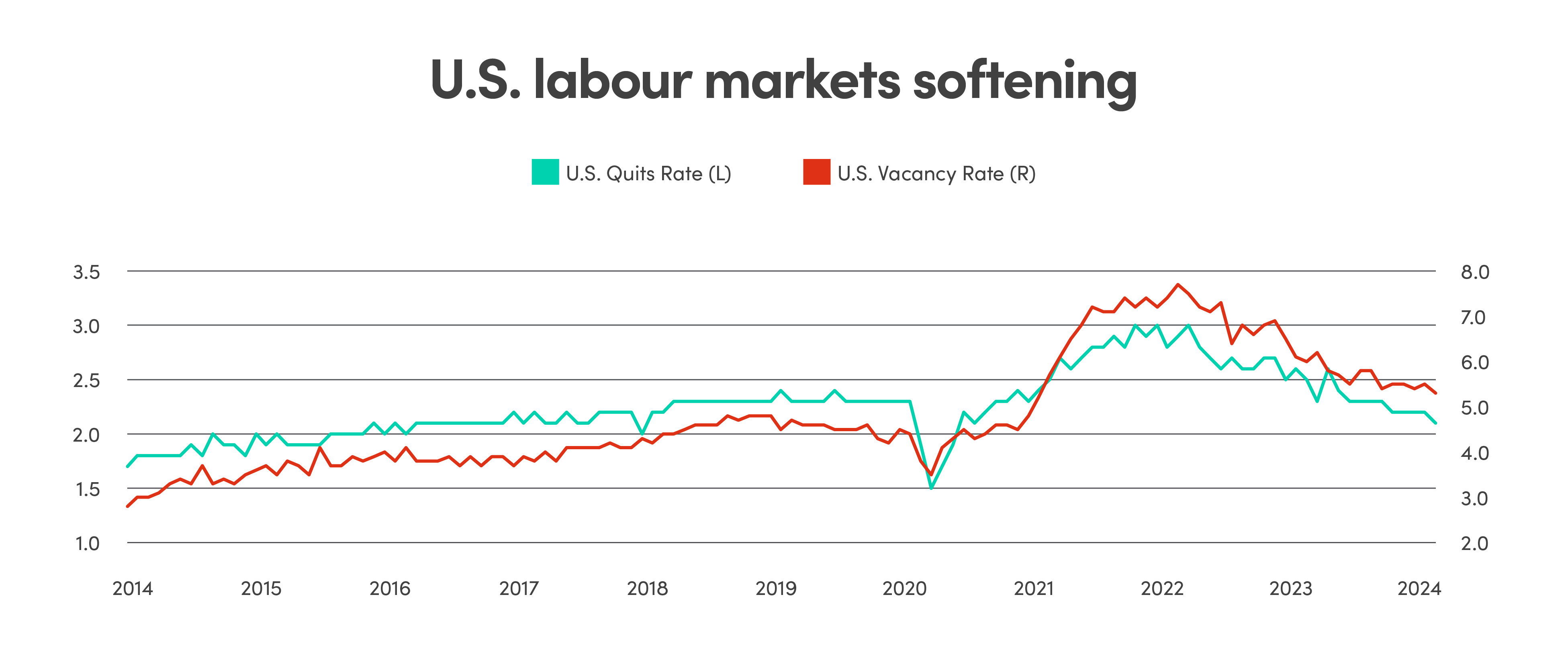

Job market continues to ease

One of the key drivers in the continued strength of the U.S. economy has been the labour market, which has been remarkably robust and the weakening of which would also be an early indicator of economic weakness as it has been in numerous recessions in the past. The most recent jobs report in March suggest that the U.S. labour market remains robust but is beginning to cool. The number of U.S. job openings decreased, with the quits rate also declining to the lowest level since August 2020.

Source: Bloomberg LP

Other indicators also corroborate the softening in labour market conditions. The job openings rate fell to 5.1% in March, after three consecutive months at 5.3%, meaning the upward trend in hires appears to be levelling off. Along with softer labour demand, the quits rate has also continued to fall, amounting to an easing of labour market slack. The vacancy-to-unemployment rate, is yet to return to the pre-pandemic level, but remains on a path to come into balance.

Bottomline: We expect the labour market to continue to ease along with wage growth, alleviating inflationary pressures later in the year.