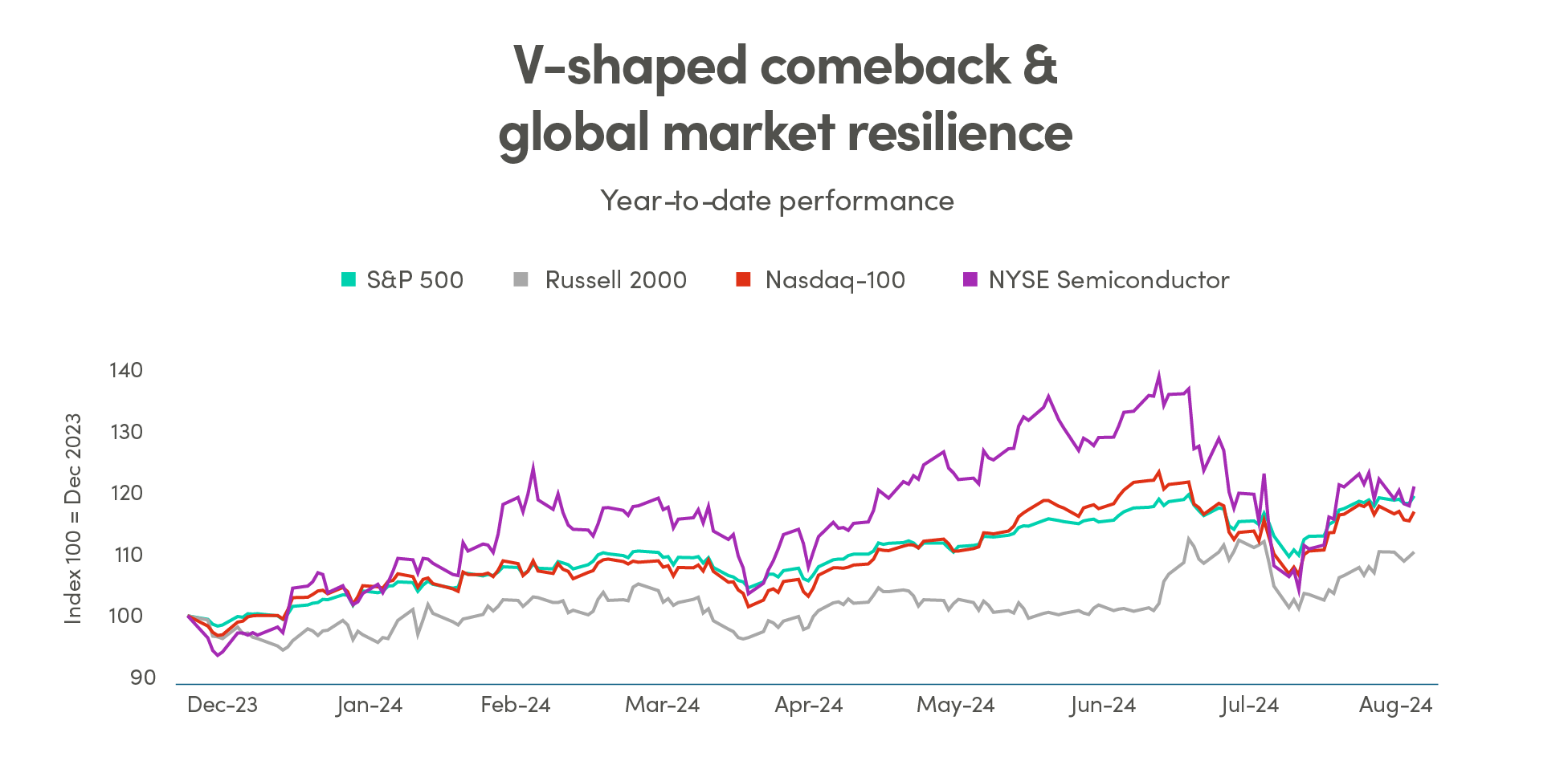

V-shaped comeback & global market resilience

The sharp selloff in early August was followed by a notable recovery in global markets driven by positive economic data releases in the U.S. that restored investor confidence. In the U.S., unexpected strength in retail sales and resilient consumer spending alleviated recession fears, while in Europe GDP growth also bolstered confidence. This recovery has coincided with a sector rotation toward value and small-cap stocks, which stand to benefit from anticipated rate cuts by the Fed. Additionally, supportive monetary policies from central banks worldwide have created a favourable environment for market stabilization.

Source: Bloomberg

Source: Bloomberg

In this sell-off, the magnitude of the drawdowns varied greatly by sectors and factors. As bond yields drifted lower, defensive sectors stood out as safe havens relative to the cyclical sectors. Low valuation held up better than companies that are rich on valuation, and large-cap companies outperformed small-cap companies. Importantly, bonds fulfilled their traditional risk-mitigating role as higher bond prices offset stock price weakness in a balanced portfolio. While most asset classes recovered from the bout of market volatility unscathed, these recent events demonstrate that investors are treading carefully amid market uncertainty and elevated market valuations. This speaks to the need for investors to avoid making quick decisions based on short-term volatility.

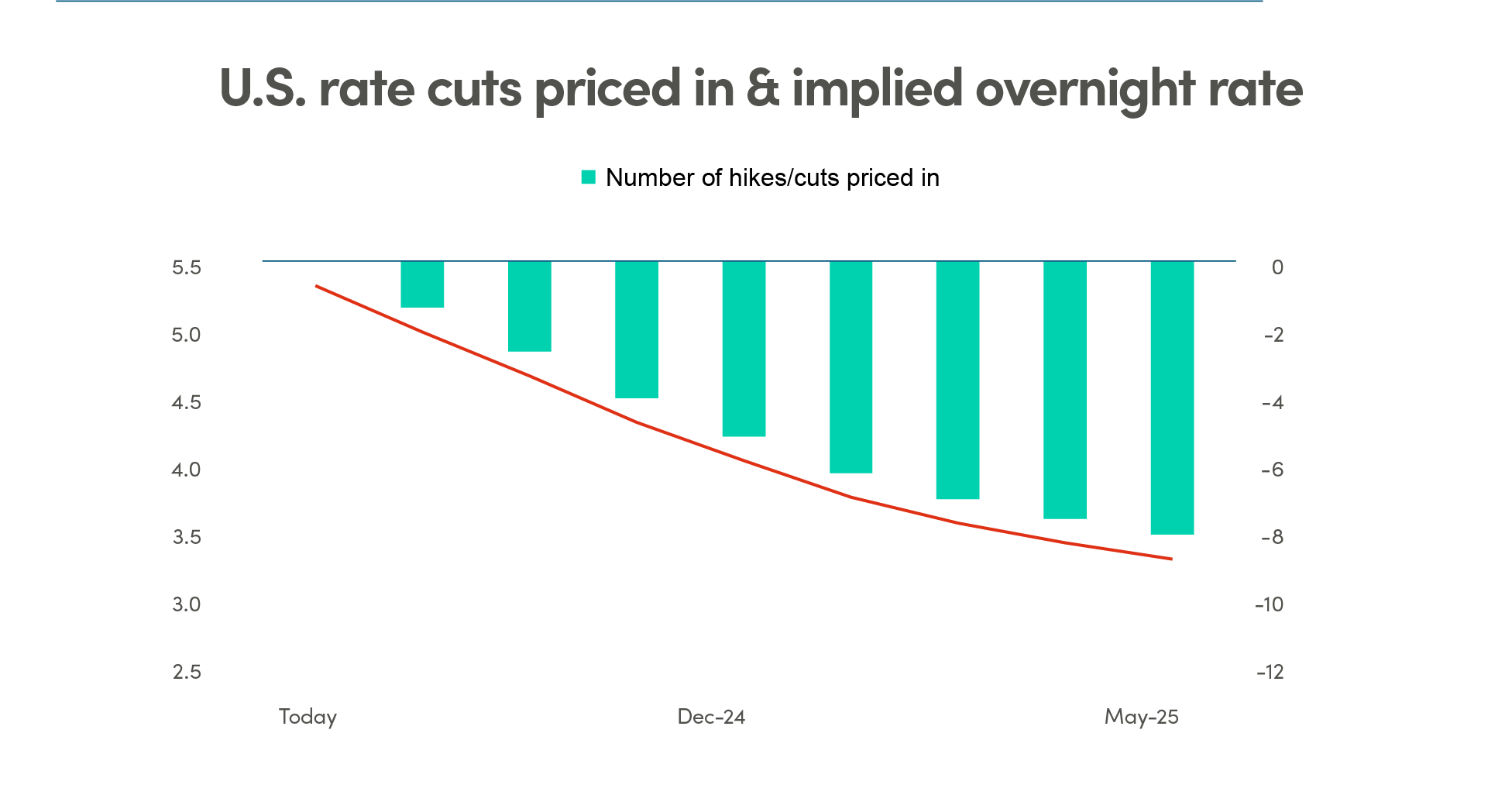

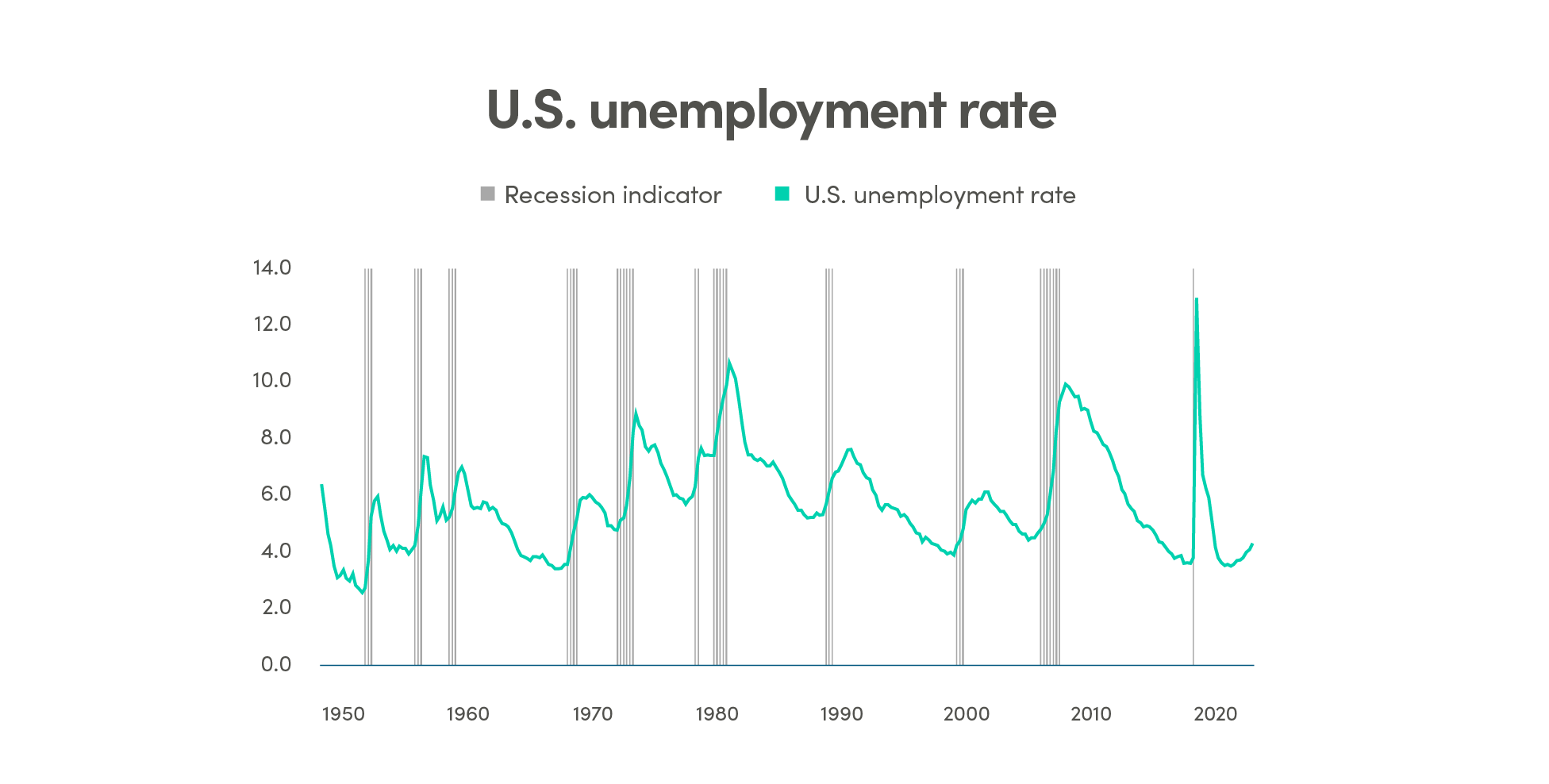

Dovish pivot at Jackson Hole

In his recent Jackson Hole speech, Fed Chair Jerome Powell signaled a notable pivot in the Fed's tone, shifting from a primary focus on taming inflation, to concerns about the labour market. This suggests that the central bank could be adopting a dovish stance and becoming more attentive to employment dynamics as unemployment rates rise, which could lead to potential rate cuts in the near future. Market reactions have already begun to reflect this outlook, with investors pricing in four rate cuts by the end of the year in the U.S.

Source: Bloomberg, NEI Investments.

Source: Bloomberg, NEI Investments.

Source: Bloomberg, NEI Investments.

Source: Bloomberg, NEI Investments.

As the narrative evolves, the implications for the broader market are significant; a focus on labour market stability rather than inflation could foster a more supportive environment for equities, particularly in sectors sensitive to interest rates. As central banks begin the easing cycle, the yield curve tends to steepen, which also tends to give way to positive returns in fixed-income investments.

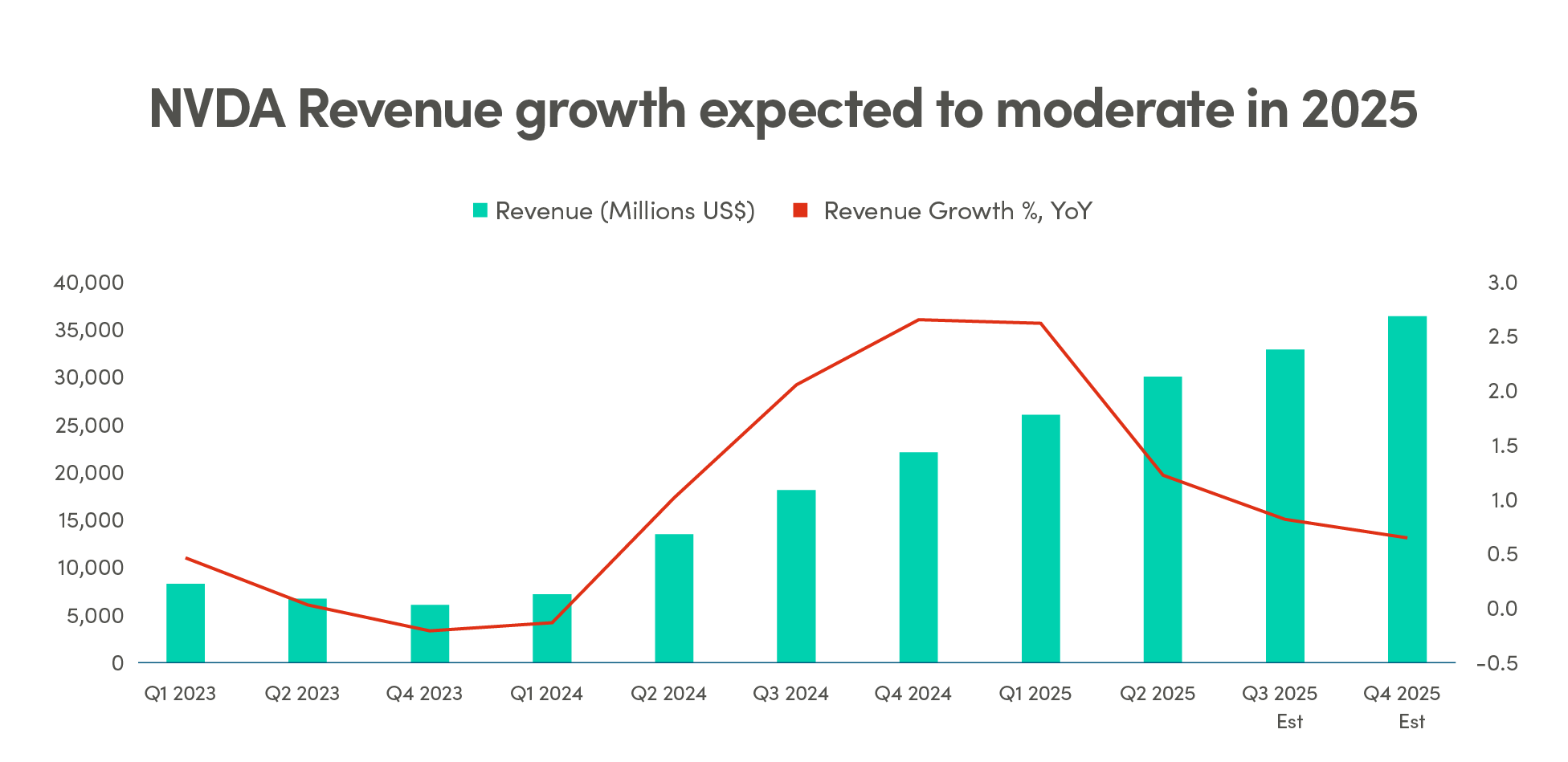

Nvidia’s earnings highlight AI growth skepticism

The recent surge in AI investment is exemplified by Nvidia's (NVDA) impressive Q2 earnings, which featured a remarkable 122% year-over-year revenue increase, reaching $30.0 billion. Data centre revenue, a key metric for Nvidia, saw a 154% increase to $26.3 billion, highlighting the broader implications for capital expenditure on technology infrastructure as firms enhance their AI capabilities. However, Nvidia's next-generation Blackwell AI chips have faced delays, raising caution among investors. Despite beating Wall Street expectations, Nvidia's shares fell over 3% in after-hours trading following the earnings release, prompting a re-evaluation of whether its growth rates justify its current valuation.

Source: Bloomberg.

Source: Bloomberg.

While Nvidia is still a key indicator of AI demand, caution is warranted; the focus is not just on the chipmaker but on the broader implications for capital expenditure on technology infrastructure. As major firms ramp up their AI capabilities, investors may soon begin to shift their attention from foundational providers such as Nvidia to beneficiaries of AI adopters and users. Investors need to stay vigilant to look beyond quarterly results and consider how the AI landscape is rapidly evolving, especially as new winners emerge and competition intensifies.